Insights

Our biggest calls in recent years

Endeavor has published our portfolio and research advice to clients in a monthly report for 18 years. The net results for clients is shown in ABOUT US, THE FIRM section of the website.

Please see below four examples of our outperforming insights made for clients in recent years.

- Feb-20 – CV19 was a very major problem & went 15%+ Cash & Defensive. Initial analysis of CV19 highlighted it was much larger problem than SARS. Creation of CV19 Advisory Panel late Feb-20 assisted this (3 x specialist medical doctors & with relevant research background (please contact us for relevant report)

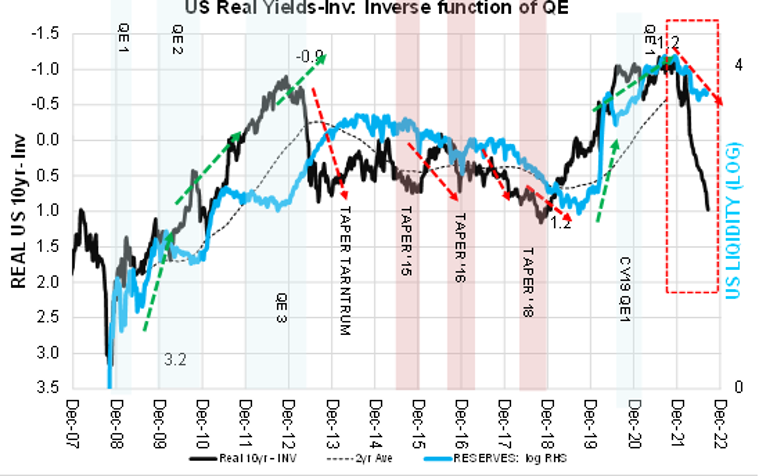

- 18mths to Sep-22 – Real Rates would rise materially hitting Growth/duration & benefiting Value due to QE Suppression ending. Sounds obvious now however was non-consensus early 2021 with the Transitory Inflation/ Structurally low growth views dominating. (please contact us for relevant report – key chart is below which we were highlighting in Q3-21)

Chart 1: Real Yields are an Inverse Function of Fed Liquidity Risk Premium suppression

Our biggest calls in past 5-15 years

- 2016 – Bullish in US Centric stocks (eg JHX, CPU, CSL) for a US renaissance under Trump’s MAGA policies.

- Jan-2008 – Very Bearish & Underweight ASX Bank Stocks due to clear present danger of US financial system coming under pressure due to Non-Prime Housing Lending & likely recession.

CONTACT US

Want to learn more about our investment process?

Reach out to us