UNIQUE APPROACH

Disciplined, Top Down investing with Company implementation

We generate alpha by insights, robust thinking & fundamental models to identify disparities between fundamentals & sentiment

A Focus on Fundamentals

Endeavour’s process focuses on fundamentals with a particular focus on the profit & economic cycle. The process is driven by hundreds of indictors in three key categories: profits, valuation & liquidity.

Profits

Research shows Company Profits are a much stronger determinant of sharemarket performance than economic cycles. Global profits are the critical determinant of our sector & stock positioning

Valuations

Defensible Franchise Value process – robust common-sense principle buys cheap companies which are both profitable & profitably reinvesting. In operation at Endeavour for over 15 years, developed in 2001

Liquidity

Liquidity an essential component of global financial markets & economies. Our proprietary models monitor a broad array of liquidity indicators.

Profits

Research shows Company Profits are a much stronger determinant of sharemarket performance than economic cycles. Global profits are the critical determinant of our sector & stock positioning

Valuations

Defensible Franchise Value process – robust common-sense principle buys cheap companies which are both profitable & profitably reinvesting. In operation at Endeavour for over 15 years, developed in 2001

Liquidity

Liquidity an essential component of global financial markets & economies. Our proprietary models monitor a broad array of liquidity indicators.

Endeavour also employs Sentiment indictors. Returns are greatest when capital is scarce. Endeavour uses sentiment indicators to identify a capital scarcities & excesses.

Endeavour’s investment philosophy goes back to original research & experience over 20 year of successful operation. Out expertise lies in the disciplined process of combining Macro Research Profits, Valuations & Liquidity measures in order to provide superior risk adjusted investment returns.

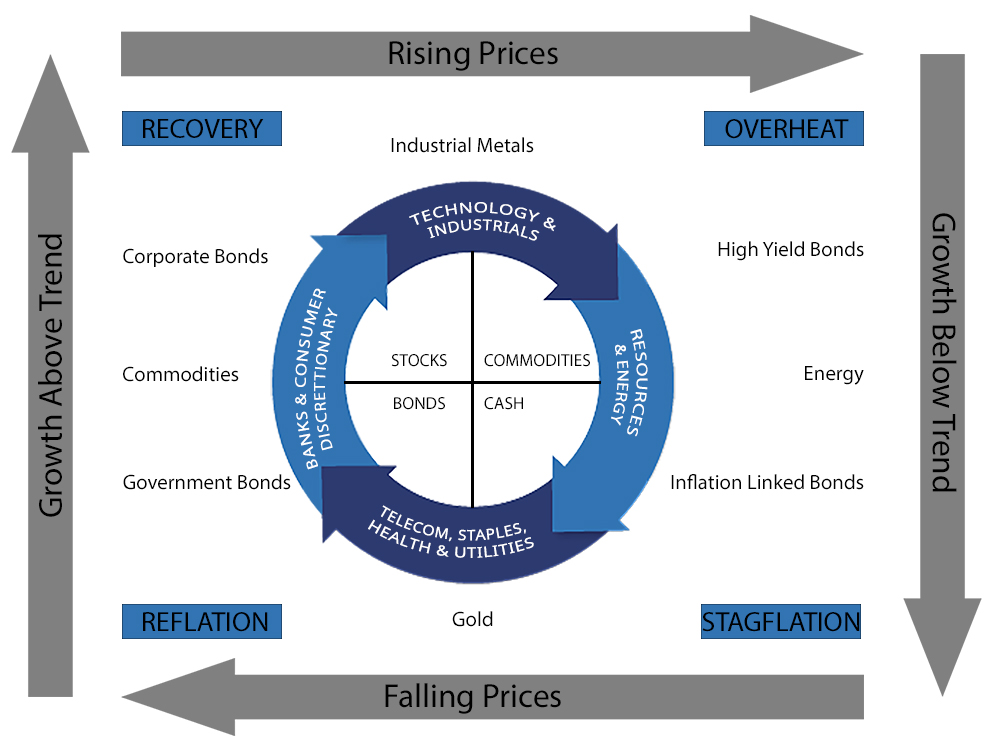

Analysis of global profit & economic cycles is a core component of our strategies. We identify inflection points in global business cycles & allocate appropriately across asset classes, styles, size, industries & themes. Examples of assets & market segments we may favour at various points in the cycle are highlighted below.

Endeavour’s investment philosophy goes back to original research & experience over 20 year of successful operation. Out expertise lies in the disciplined process of combining Macro Research Profits, Valuations & Liquidity measures in order to provide superior risk adjusted investment returns.

Analysis of global profit & economic cycles is a core component of our strategies. We identify inflection points in global business cycles & allocate appropriately across asset classes, styles, size, industries & themes. Examples of assets & market segments we may favour at various points in the cycle are highlighted below.

CONTACT US

Want to learn more about our investment process?

Reach out to us